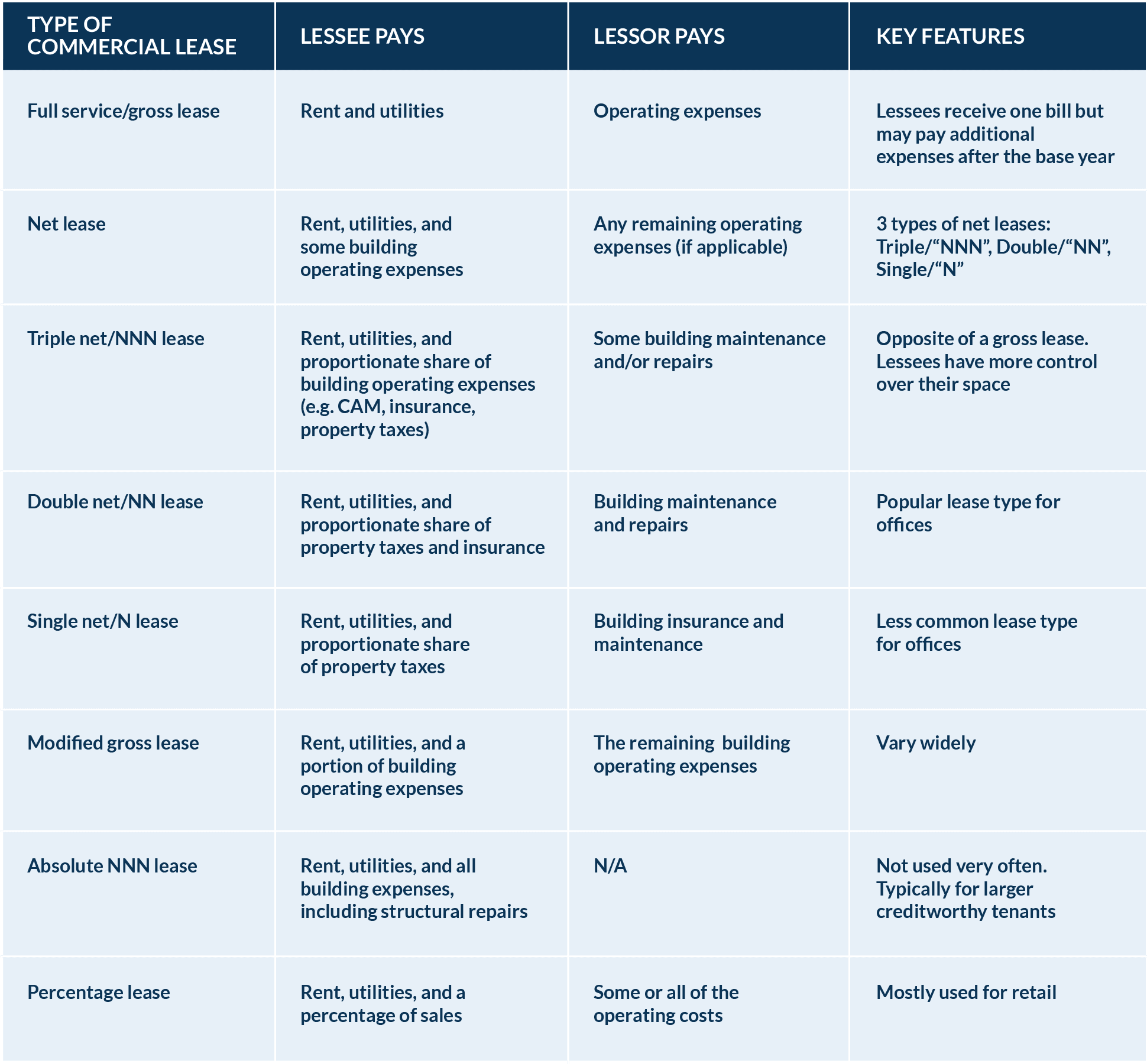

Commercial Lease Types Explained Triple Net, Gross & More

Most commercial real estate listings are priced per sq. ft. often separating Base (Net) rent and Additional rent. This often looks odd and confusing to the average person. I get asked by many.

sample equipment rental agreement pdf

The concept of TMI is crucial in understanding the financial obligations involved in a commercial lease agreement. Elements of TMI TMI stands for Taxes, Maintenance, and Insurance. These are the three main components of the total monthly investment (TMI) that a property owner or tenant has to pay for a real estate property.

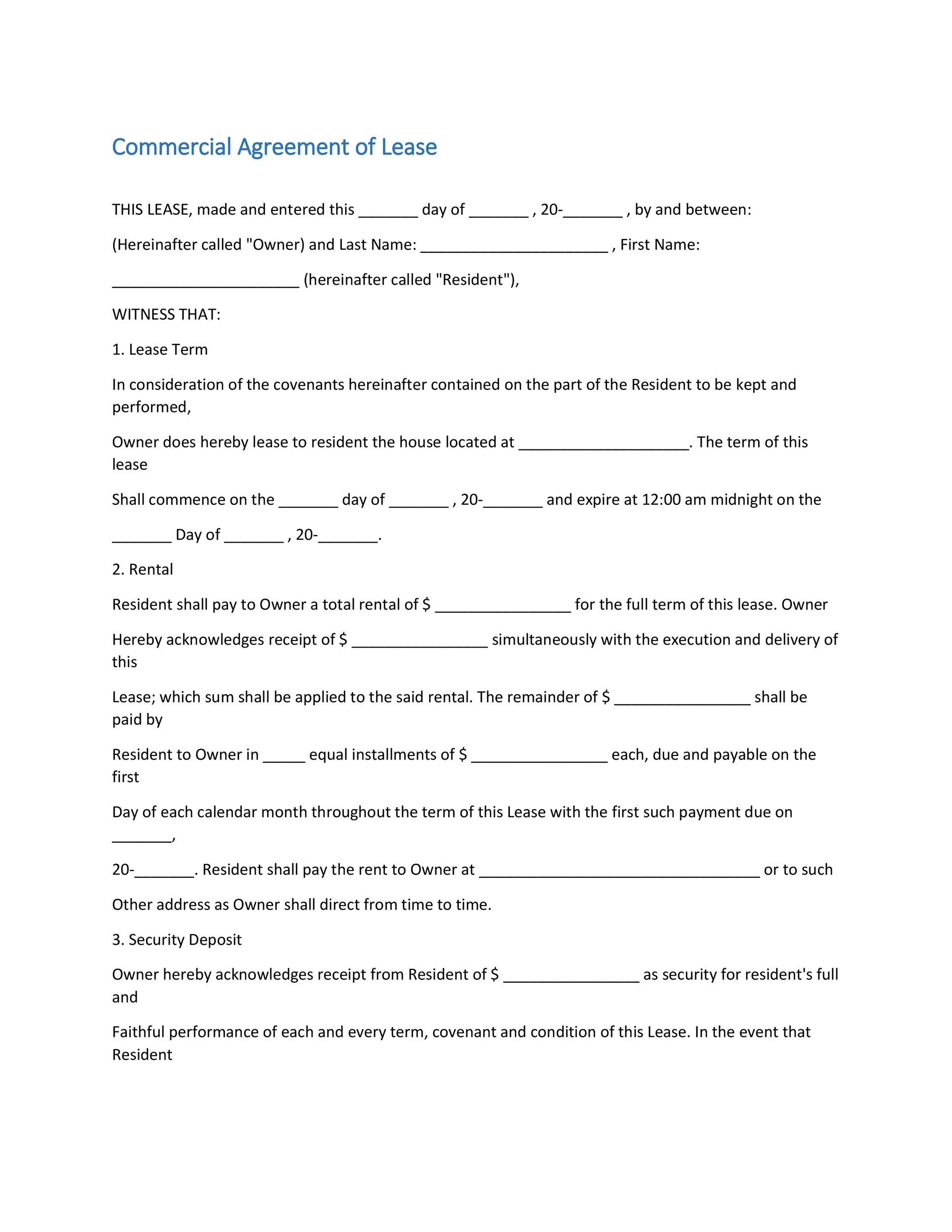

Blank Lease Agreement Template in Google Docs, Word, PDF

A triple-net lease, often used with single-user industrial facilities, means that the tenant pays "TMI" - taxes, maintenance, and property insurance. Tenants also are responsible for all costs associated with their occupancy, including personal property taxes, janitorial services, and all utility costs.

Commercial Lease Agreement Form Download Printable Form, Templates

Answer: Usually, you would find something in the Lease and that would govern, but assuming that the entire TMI issue is overlooked, the default position is that the TMI is the responsibility of the Tenant to pay directly. This also means that no notice of any kind would be required.

Lease Extention Option Rights Benefits Tenant Only

Total Monthly Investment (TMI) is an important concept in real estate that encompasses the various costs associated with owning a property. These costs include property taxes, maintenance expenses, and insurance premiums.

Free Commercial Lease Agreement Template Word Uk Printable Templates

In addition, Florida imposes revenues tax on leases of commercial property, so quite of these amounts are also built-in to TMI. Why is TMI separate from the base rent? It's ampere common practice forward landlords to give their monthly rent inbound terms of a price per four footer, so tenants like you can compare different spaces.

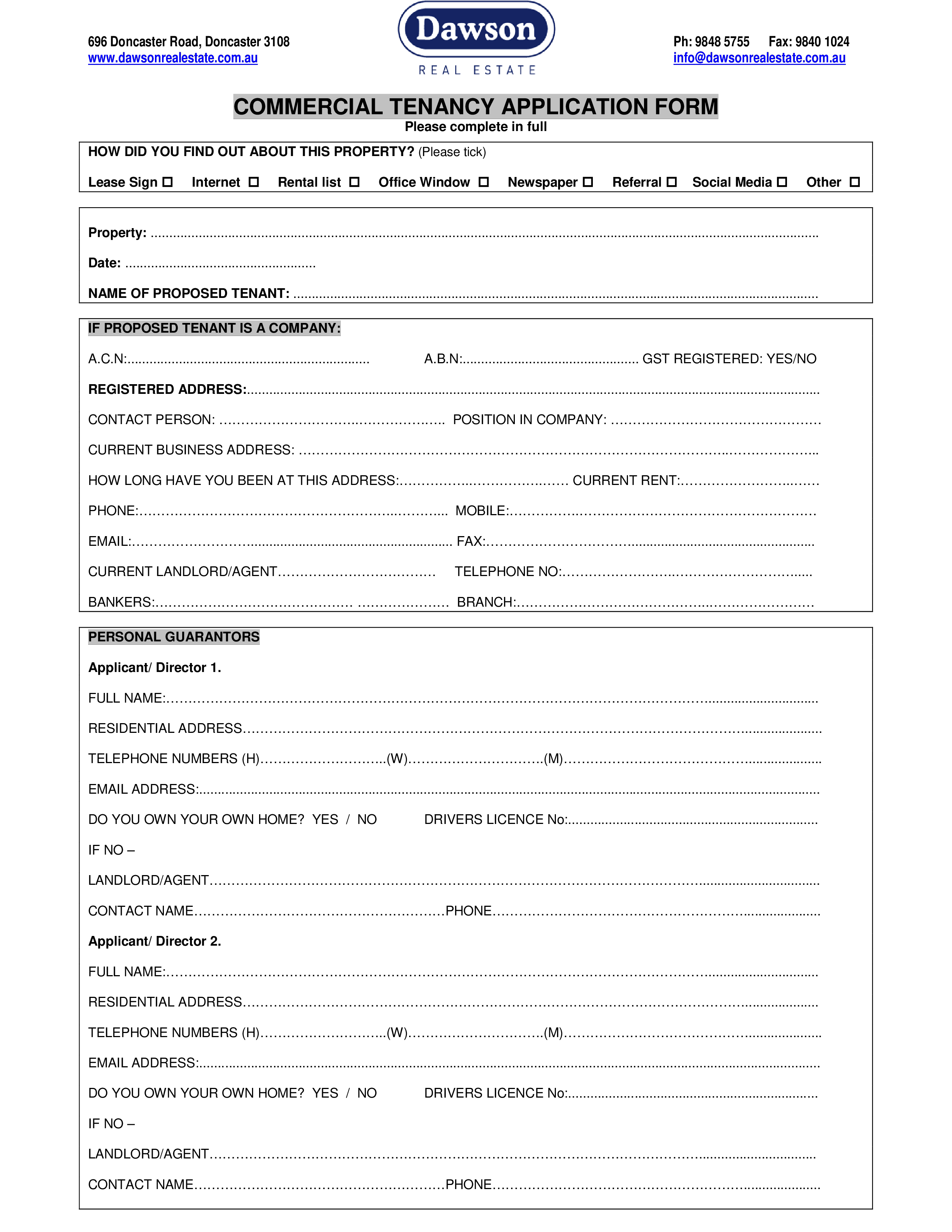

Commercial Tenant Lease Application Form Gratis

In addition, Florida imposes sales tax on leases of commercial property, so some of these amounts are other built-in to TMI. Why is TMI cut from the base rent? It's an common practice available proprietors to introduce your monthly rent in terms of a pricing by square footage, so tenants like you ability compare varied spaces.

Commercial Property Lease Agreement Template in Google Docs, Word

Office Space located in some commercial buildings don't include utilities in the T.M.I. Please refer to the "Utilities Included" box for each property to verify if included. What's "Tenant Inducements" - Free Rent Negotiate with the Landlord for some free rent time in order to set up your Business.

Maryland Rental Lease Agreement Template [2023] PDF & DOC

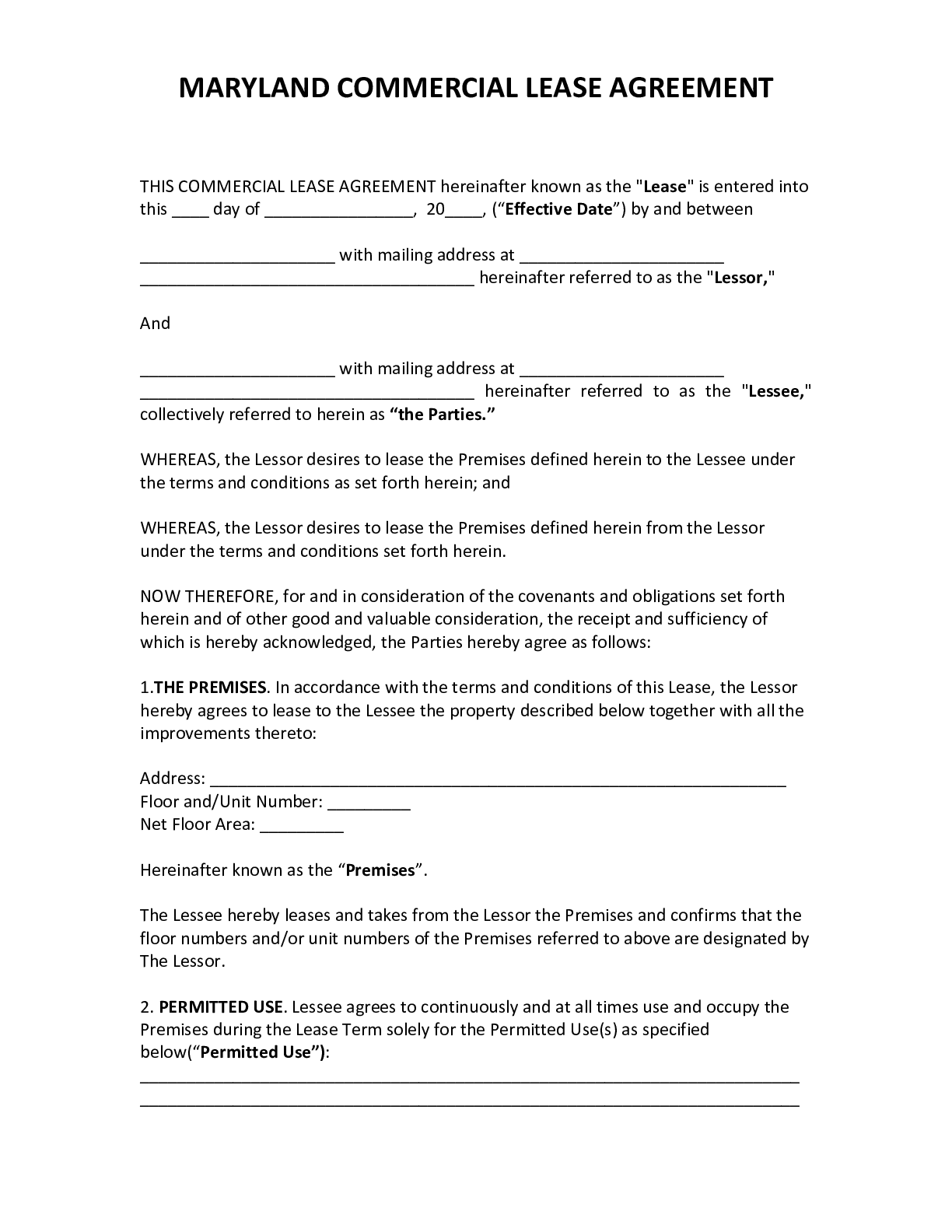

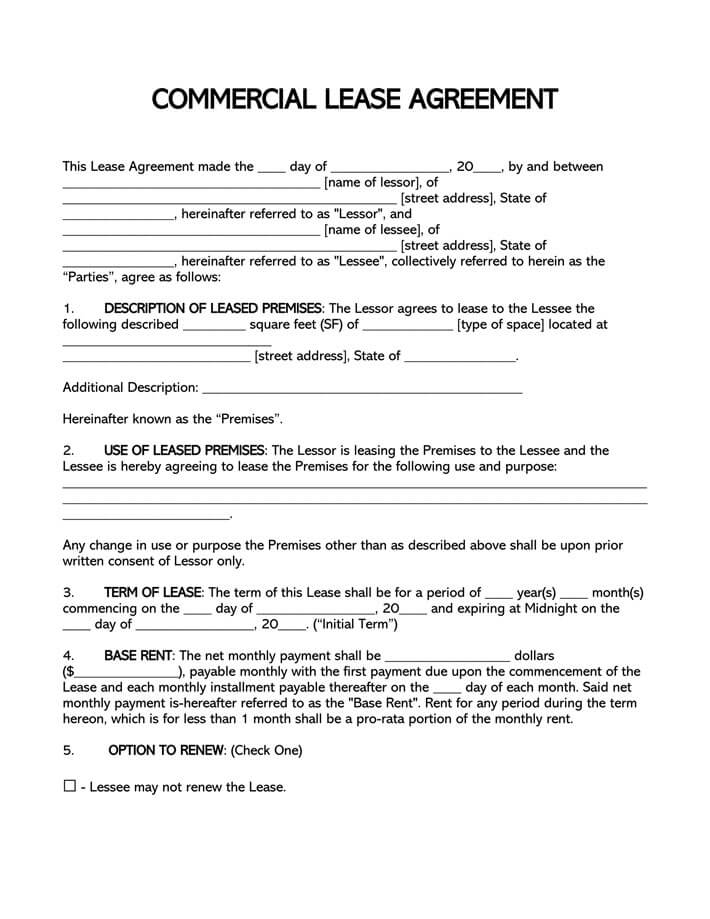

A commercial lease agreement is a binding contract between a landlord and a tenant for the rental of a property specifically for business purposes like office, retail, commercial or industrial space. This will contain the terms and conditions of the lease including the rent, term, penalties and allowed uses of the property.

Commercial Lease Agreement Template South Africa

Home » What is TMI in a Commercial Lease? October 01, 2019 Business Law If you're new to commercial leasing, you're probably quite amazed by the highly technical, meticulous nature of the contract.

47+ FREE Lease Agreement Templates [Edit & Download]

TMI is a term used to describe the costs associated with leasing commercial space. It typically includes three main expenses: property taxes, maintenance fees, and insurance premiums. These costs are in addition to the base rent you will pay for the space. Understanding TMI is essential when negotiating a lease agreement.

11 Steps to Signing a Commercial Lease and Opening Your Store

TMI; TMI stands for "Taxes, Maintenance and Insurance". This acronym is often used in a net, double net or triple net lease where the tenant is responsible for paying a portion or all of these expenses.. or if you require assistance with negotiating lease terms or drafting or reviewing a commercial lease. Call us. Toronto 197 Spadina Ave.

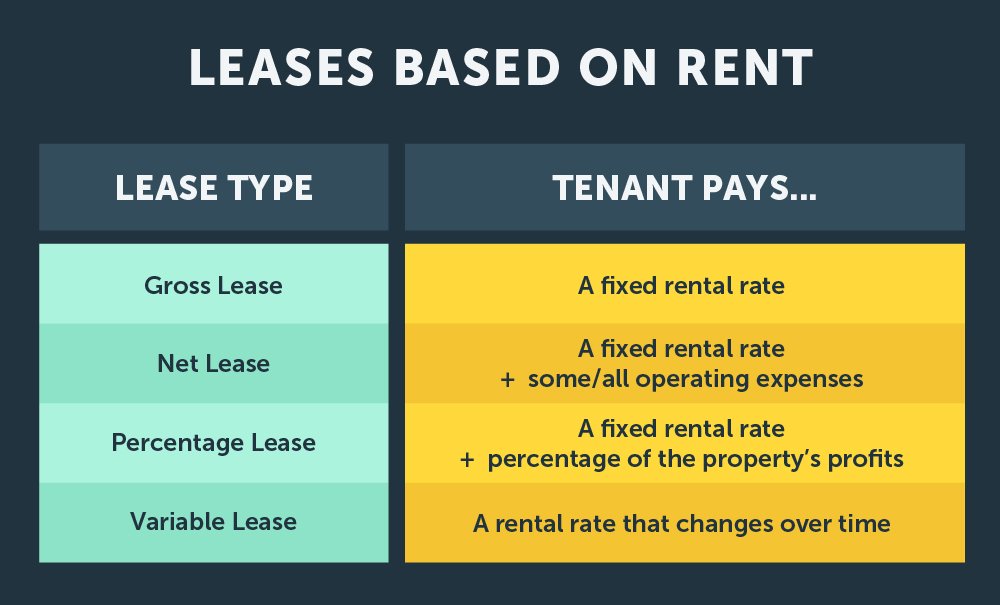

The Four Types of Commercial Leases

Lessor A lessor or landlord legally owns the asset or property. They may be a person, company, or legal entity. They lease the property or asset by giving the lessee the right to use or occupy it for a specified period. Lessee A lessee or tenant pays rent for the right to occupy or use the property. They may be a person, company, or legal entity.

26 Free Commercial Lease Agreement Templates Template Lab

With commercial transactions, buyers or tenants are considered buyer clients. The costs of a warehouse in the Toronto GTA area range from $8.00 to $15.50 sq. ft. net rent, the rate increases with clearance height particularly over 22 ft. This is only an approximation based on offered lease rates.

Free Commercial Lease Agreement Template Pdf Word

What is T.M.I? T.M.I. stands for Taxes, Maintenance and Insurance. In a net rent situation, the tenant will pay a portion of the landlord's realty taxes, maintenance expenses and property insurance based on the percentage of the building the tenant is occupying.

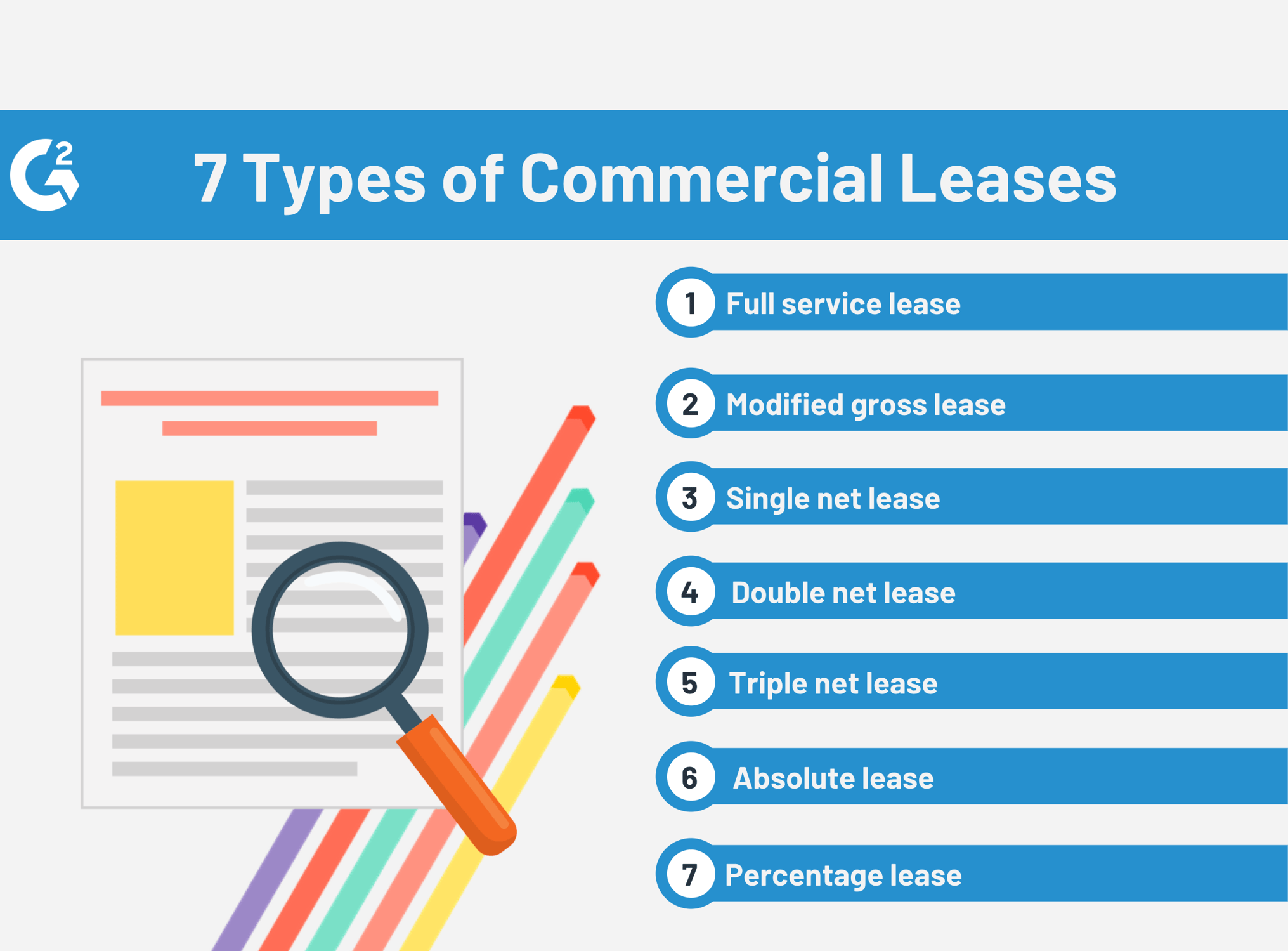

The 7 Types of Commercial Leases Explained

There are several types of commercial leases beyond a simple flat monthly or annual rent arrangement. Net lease - The tenant pays all or part of taxes, insurance, or maintenance costs that would otherwise be incurred by the landlord in addition to the stated rent. Double net lease - The tenant pays taxes, insurance, and rent. Triple net lease - The tenant pays taxes, insurance.