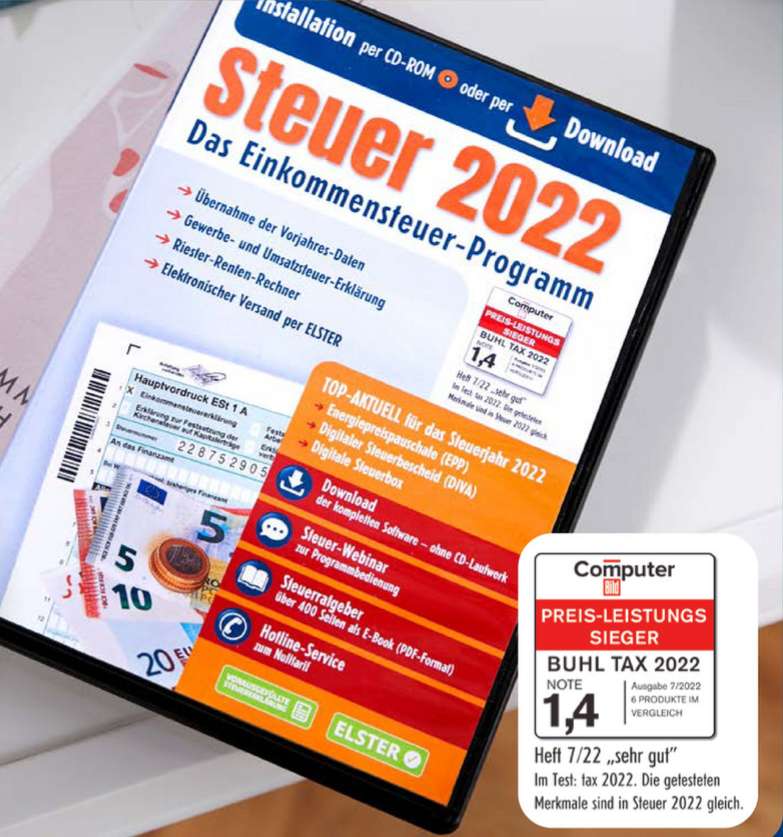

STEUER 2022 Aldi Steuersoftware Steuererklärung Nur Download, ohne CD

CRA Newsroom What you need to know for the 2022 tax-filing season February 10, 2022 Ottawa, Ontario Canada Revenue Agency Last year, Canadians filed almost 31 million income tax and benefit returns. Having the information you need on hand to file your return makes the filing process that much easier.

Steuern 2022 Finanzelot Wir verteidigen Ihr Vermögen!

TurboTax® Canada 2023-2024: Canada's #1 Best-selling Tax Preparation Software | File Taxes Online Leave your taxes to us We'll do the work to get your biggest refund, guaranteed. File with an expert File on your own Use your Intuit Account to sign in to TurboTax. Learn more Phone number, email or user ID

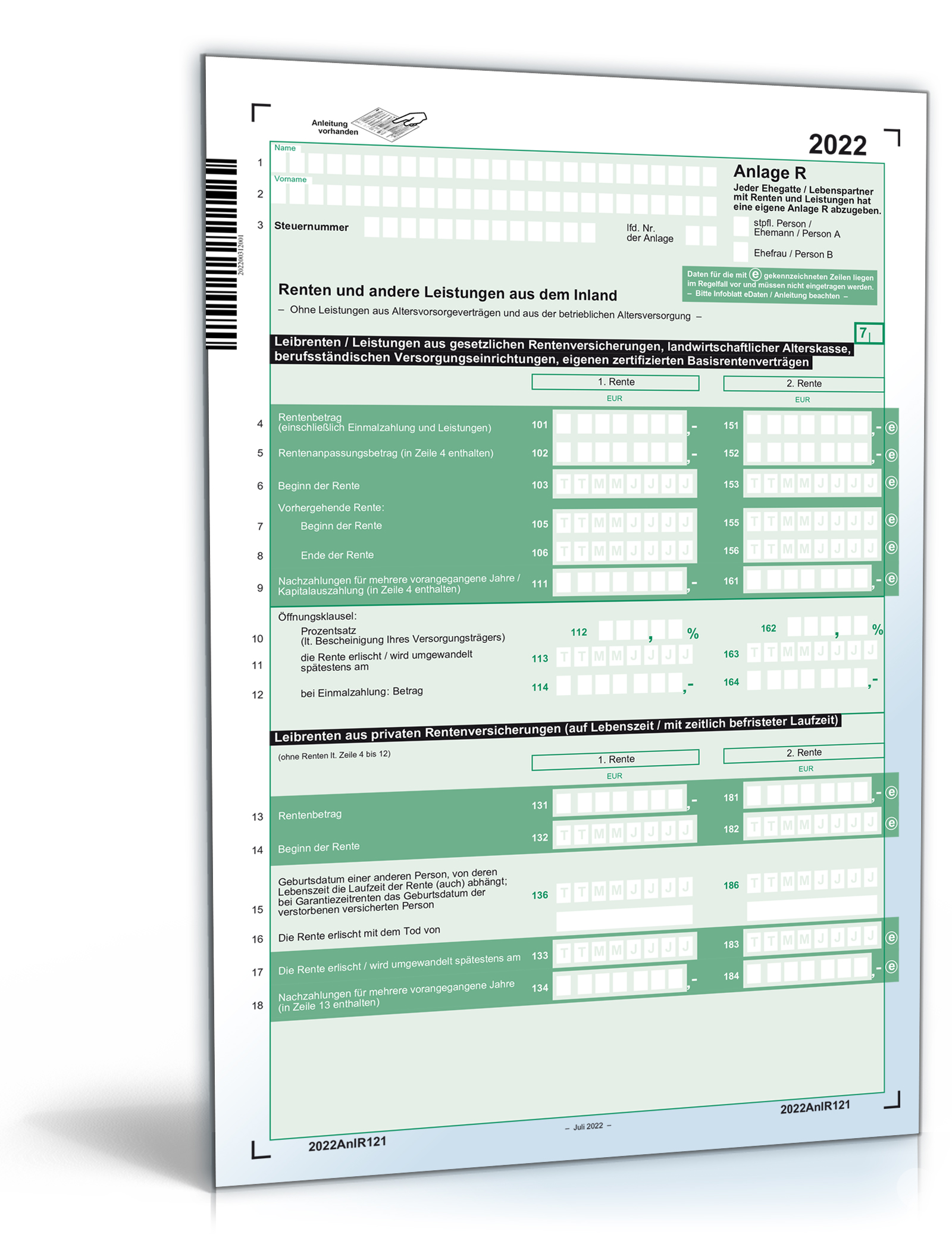

Anlage R 2022 Steuerformular zum Download

You filed your return late and you owe tax for 2022. You failed to report an amount on your 2022 return and you also failed to report an amount on your return for 2019, 2020, or 2021. You knowingly, or under circumstances amounting to gross negligence, made a false statement or an omission on your 2022 return.

Steuer 2022 für Unternehmer, Selbstständige und Existenzgründer Buch mit DVD Dittmann

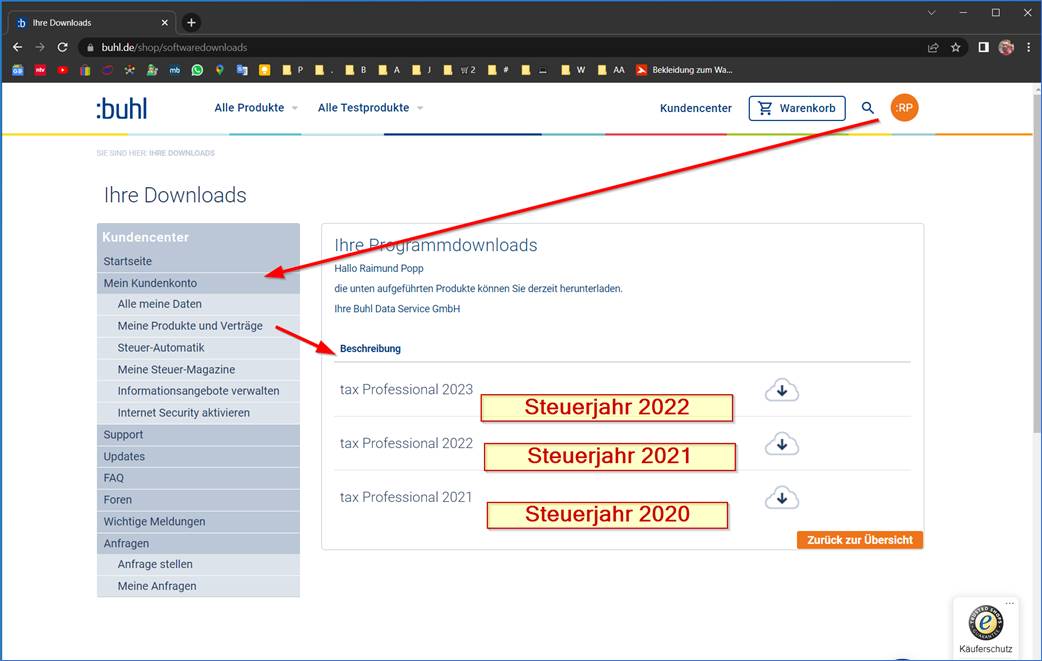

Weiterlesen ( 476 ) Bewertungen Jetzt bewerten Jetzt bestellen tax 2024 PDF-Magazin und Download im Steuer-Spar-Vertrag ab der Steuererklärung 2023. € 15,99 (Inkl. MwSt.) In den Warenkorb tax 2024 - alle Informationen auf einen Blick Ältere Versionen Sie möchten die Steuererklärung für die Jahre zuvor machen?

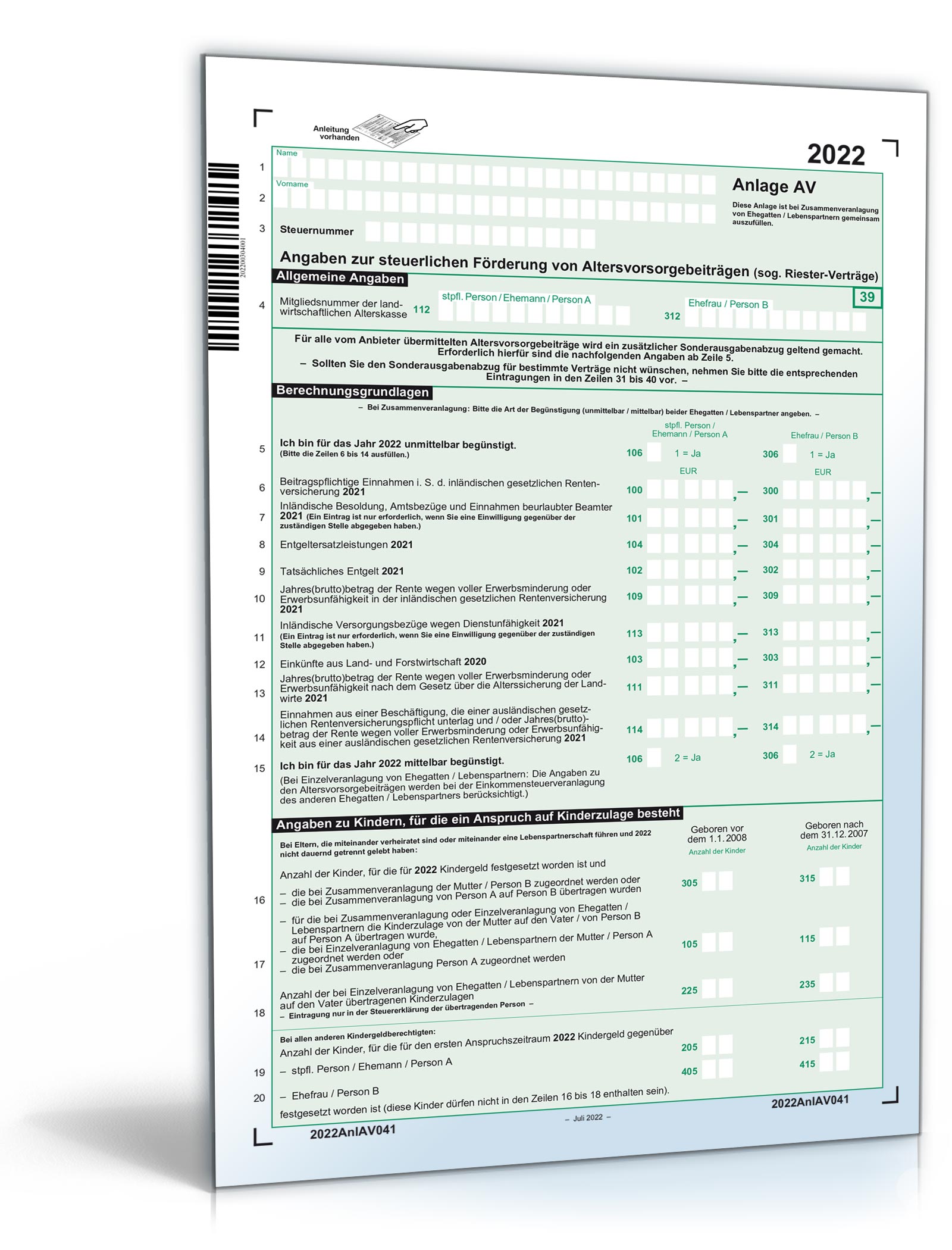

Formulare Steuererklärung 2022 Zum Ausdrucken Kostenlos

Tax Rates -> 2022-2023 Tax Rates -> Ontario Personal Ontario 2023 and 2022 Tax Rates & Tax Brackets. The Ontario tax brackets and personal tax credit amounts are increased for 2023 by an indexation factor of 1.065 (6.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not indexed for inflation.

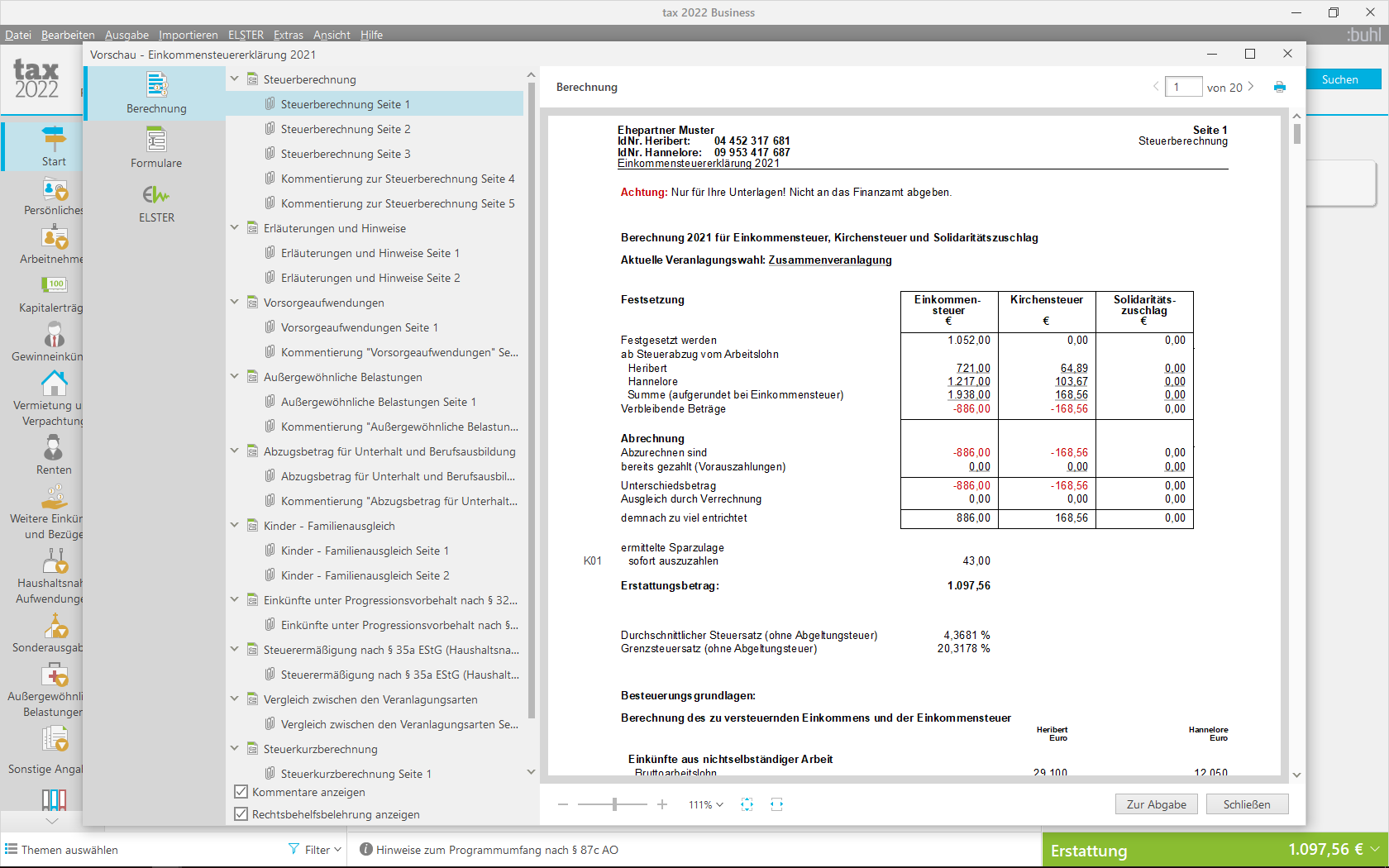

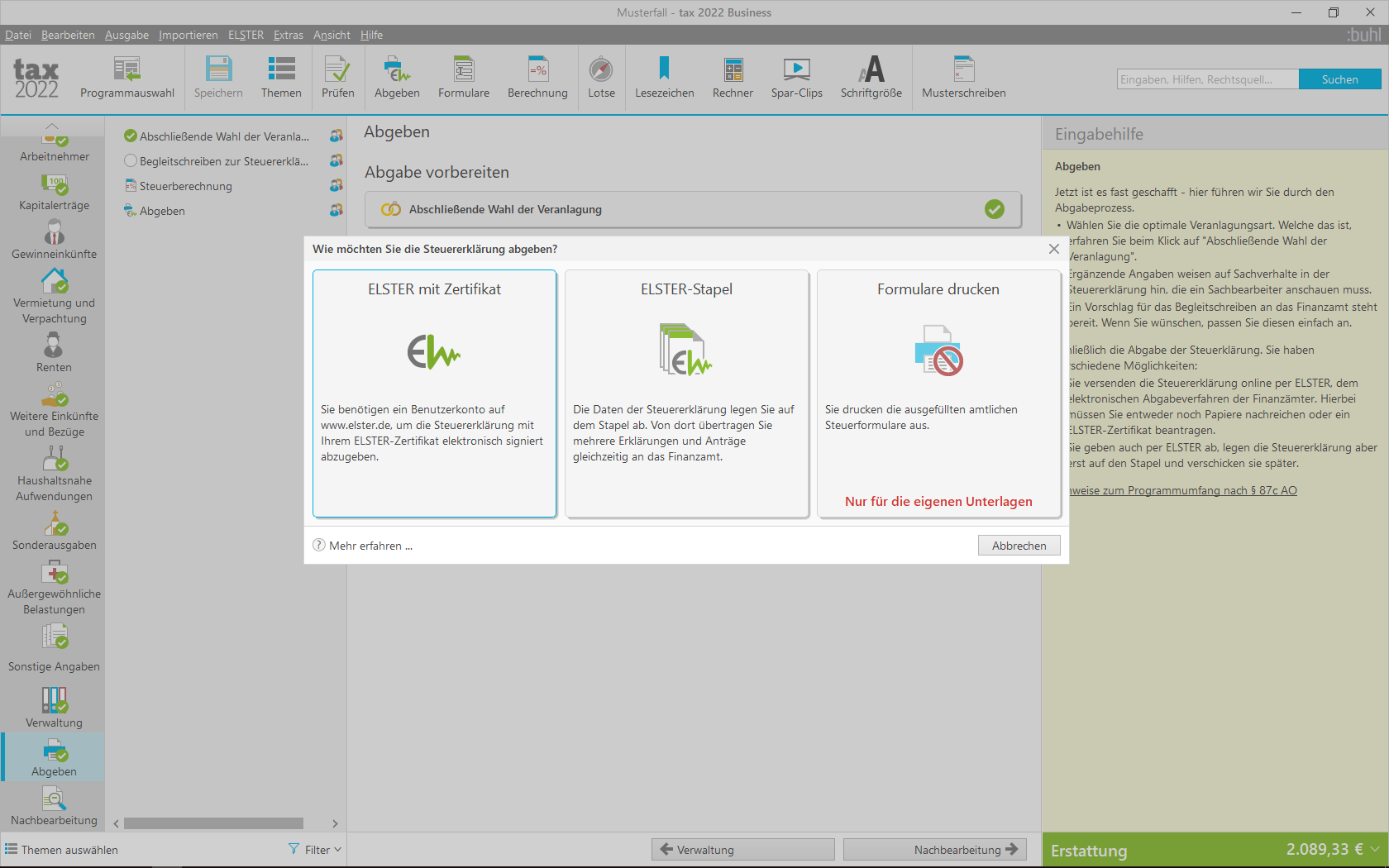

tax 2022 Business kaufen Die Lösung für SteuerProfis Buhl

The tax rates in Ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%. Ontario's marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket. Learn more about Ontario's marginal taxes.

tax 2022 Business kaufen Die Lösung für SteuerProfis Buhl

Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Plus, explore Canadian and provincial income tax FAQ and resources from TurboTax. Province Employment income Self-employment income Other income (incl. EI) RRSP contribution Capital gains & losses Eligible dividends Income taxes paid (Federal)

WISO Steuer 2022 So funktioniert die vorausgefüllte Steuererklärung › Macerkopf

Annual German tax return (Einkommensteuererklärung) A large proportion of taxpayers in Germany, both expats and German citizens, choose to submit an annual income tax return ( Einkommensteuererklärung) to the Federal Central Tax Office.

Anlage AV 2022 Steuerformular zum Download

You've come to the right place. TurboTax for Tax Year 2022 is now available. Whether you choose to do your taxes yourself, with some help, or hand them off to a tax expert- we've got you covered. We specialize in three things: taxes, taxes and taxes. Every day.

SteuerRatgeber 2022

Use this worksheet to calculate some of the amounts for your Ontario credits. Form ON-BEN - Application for the 2023 Ontario Trillium Benefit and Ontario Senior Homeowners' Property Tax Grant. Schedule ON428-A - Low-income Individuals and Families Tax (LIFT) Credit. Schedule ON479-A - Ontario Childcare Access and Relief from Expenses (CARE.

2022 tax brackets AlbanyYassin

The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is.

Steuererklärung sollen ab 2022 vollautomatisch erledigt werden manager magazin

Filing dates for 2022 taxes. February 20, 2023: Earliest day to file your taxes online. April 30, 2023 (May 1, 2023 since April 30 is a Sunday): Deadline to file your taxes. June 15, 2023: Deadline to file your taxes if you or your spouse or common-law partner are self-employed.

Steuer erstellen Tax 2022 für 2021

March 31, 2023. Deadline to file your taxes (Canadians and non-residents, unless you and/or your spouse is self-employed) May 1, 2023. Deadline to pay outstanding taxes. May 1, 2023. Deadline to.

[Aldi Süd/Nord] Steuer 2022 CDROM (entspricht tx 2023, nur ohne Fahrtenbuch) + Gewerbe

On April 1, 2024, carbon taxes will increase from $65 to $80 per tonne, which means taxpayers will be paying 17.6 cents per litre of fuel at the pump, compared to the previous rate of 14.3 cents.

Was soll man wissen über die Steuererklärung 2022?

If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than May 31, 2024 (TurboTax Home & Business and TurboTax 20 Returns.

Bild Steuer 2022 (für Steuerjahr 2021) Steuern Software Thalia

tax 2022 Download. Für die Steuererklärung 2021. Privatlizenz - Updates für das Steuerjahr 2021 inklusive. € 15,99 (Inkl. MwSt.) In den Warenkorb tax 2022 - alle Informationen auf einen Blick Aktuelle Version