5 359 Form Texas ≡ Fill Out Printable PDF Forms Online

To file a request on paper, download Comptroller Form 05-359 (Request for Certificate of Account Status), complete the form, and then mail it to the Comptroller. There's no filing fee to obtain your tax certificate. Be aware that it can take a month or more to receive the certificate. Once you have the tax certificate, you'll attach it to your.

Hunter X Hunter Chapter 359 TCB Scans

In addition, all accounts for those taxes must be closed. To determine if the entity is current in tax requirements, or to close any open tax accounts, call us at (800) 252-1381 or (512) 463-4600. More information about this process is available online at www.franchisetax.tx.gov.

Bleach Chapter 359 TCB Scans

The hard work is done at the Texas Comptroller's office. A form 05-359, Request for Certificate of Account Status, takes 4-6 weeks to process and receive your tax clearance.. (Form 05-158-A) that entities must file instead of a corporate annual report. Once this annual franchise tax report is 45 days past due the entity losses its right to.

Hunter X Hunter Chapter 359 TCB Scans

The following entities must use Form 05-359, Certificate of Account Status (PDF), or Form 05-391, Tax Clearance Letter Request for Reinstatement (PDF), and submit the appropriate request by mail: Entities that are part of a combined group. Entities that have been active for franchise tax for less than one year.

Form 00370 Agreement Between The Comptroller Of Public Accounts And

In both cases, write the word PREMATURE across the top of the report(s). Include Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entity's Existence in Texas or Registration (PDF). The entity must file this certificate as part of the termination filing to end the entity's existence with the Secretary of State.

Hunter X Hunter Chapter 359 TCB Scans

Complete Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entity's Existence in Texas (PDF), to obtain a certificate for filing with the Secretary of State. The certificate is available in hard copy or PDF format.

Lexus LX 570 (URJ200) 2016 for Spin Tires

Forms for reporting Texas franchise tax to the Texas Comptroller of Public Accounts.. 05-397, Unincorporated Political Committee Statement (PDF) Status Change or Closing or Reinstating a Business . 05-359, Request for Certificate of Account Status (PDF) 05-391, Tax Clearance Letter Request for Reinstatement (PDF)

359 wilB Flickr

Use form 05-359 (PDF, 225KB) to request the certificate. An entity that is a member of an affiliated group required to file a combined report should complete Form 05-359 and, in Section A, provide the name and taxpayer number of the entity that will report franchise tax on the entity's behalf.

Sikafloor 359 AU 20L Kit Sydney Industrial Coatings

Use Form 05-359 to request a Certificate of Account Status from the CPA. The filing fee to dissolve a Texas corporation is $5 for nonprofit corporations and $40 for any other type of corporation. The two most common reasons the Secretary of State rejects a Certificate of Termination is because either the wrong certificate type is attached or a.

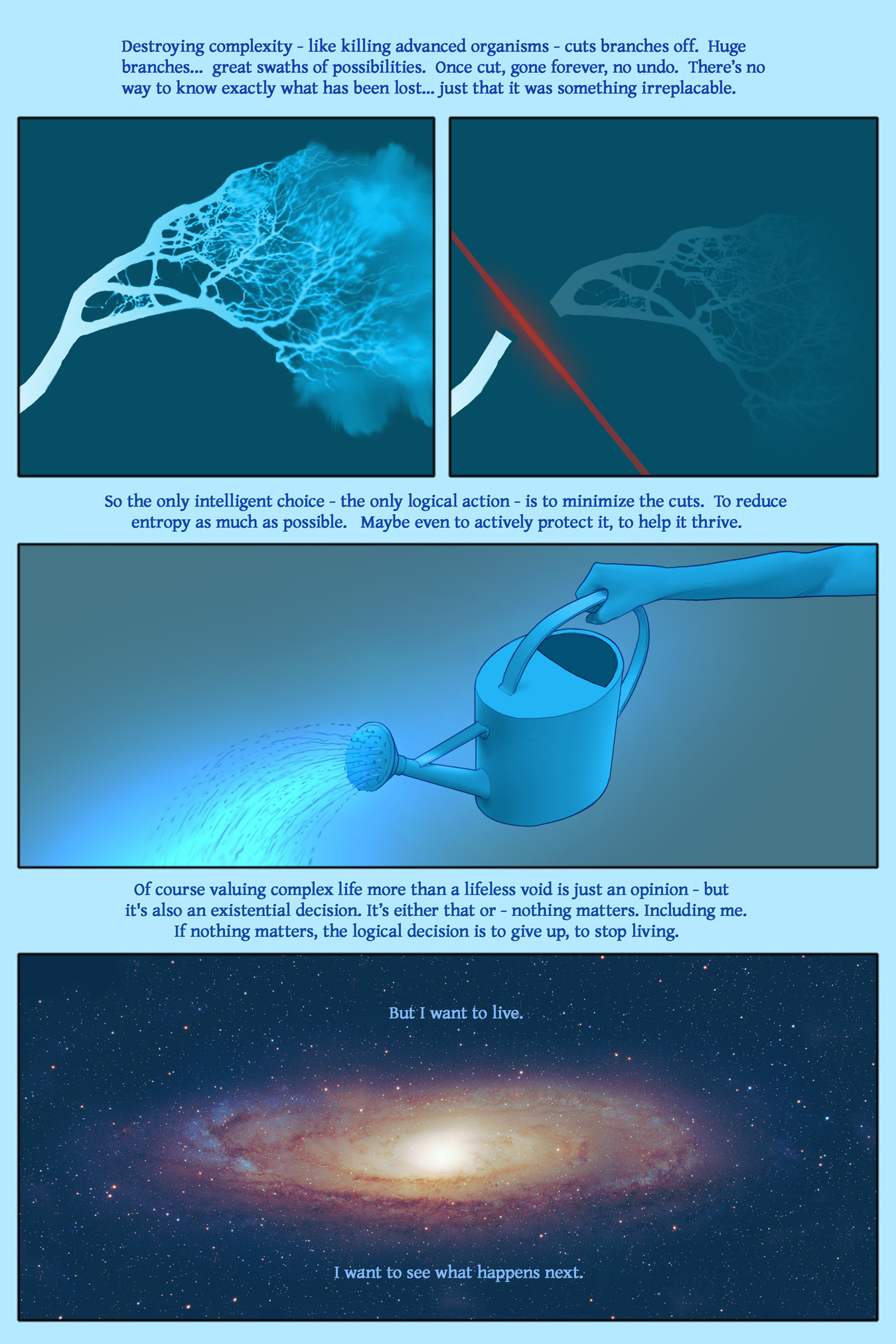

Page 359 Android Blues

Requesting the Certificate requires completion of Form 05-359 which can either be submitted online, triggering a 4-6 week wait to receive the Certificate, or submitted in a Field Office, which can issue the Certificate the same day on site.. The form can be submitted online, by fax, or by mail. After receiving the Certificate of Termination.

Hunter X Hunter Chapter 359 TCB Scans

Nonprofit corporations. To request a Certificate of Account Status, use Comptroller Form 05-359 (PDF, 225KB) and/or contact the Comptroller at: Tax Assistance Section, Comptroller of Public Accounts. Austin, Texas 78774-0100. (512) 463-4600; toll-free (800) 252-1381; (TDD) (800) 248-4099.

Bleach Chapter 359 TCB Scans

This form verifies that the LLC has paid all its taxes. You can request a Certificate of Account Status by using the Request for Certificate of Account Status to Terminate Entity's Existence in Texas or Registration (Comptroller Form 05-359). Regarding the Certificate of Account Status, you should be aware that:

One Piece Chapter 359 TCB Scans

05-359 (Rev.2-24/14) Request for Certificate of Account Status to Terminate a Taxable Entity's Existence in Texas. An entity that intends to terminate its legal existence or registration must satisfy filing requirements for all taxes administered by the Comptroller under Title 2 of. Form 05-359, Request for Certificate of Account Status

2012 Form TX 05359 Fill Online, Printable, Fillable, Blank PDFfiller

05-359 (rev.7-08/9) Requestor name (Please type or print) Telephone number & extension authorized agent Mail to: COMPTROLLER OF PUBLIC ACCOUNTS P.O. Box 149348. To assist you in filing these forms you can request the Certificate of Account Status in electronic (.pdf) format. Fax is also available for your convenience.

Hunter X Hunter Chapter 359 TCB Scans

You can find more information about this process (and all Texas tax guidelines) on the official Texas Comptroller's Website. You can also request form # 05-359 by email at: [email protected]. If you are not sure if your business is current with your tax requirements, call the comptroller at (800) 252-1381 or (512) 463-4600.

Texas Franchise Tax Fillable Form 05102 Texas Franchise Tax Public

A: Form 05-359 must be filed by a taxable entity that wants to terminate its existence in Texas or cancel its registration. Q: What information is required on Form 05-359? A: Form 05-359 requires information such as the entity's name, taxpayer identification number, effective date of termination, and authorized signer.