Excise duties on liquor will not be raised, says Gopalaiah Brewer

New York State Beer and Liquor Excise Tax. Distributors and noncommercial importers of beer and liquor for sale or use within New York City must pay this tax. However, if you purchase a small amount of beer or liquor while traveling outside the City and bring it into the City for personal use it is exempt from this tax. For more information.

Premium 98 Liquor Store

sales tax applicable to all alcohol sales in New York City by 3.0 percentage points, thereby raising the total tax rate for alcohol to 11.875 percent. Considering annual alcohol sales in New York City's bars, restaurants, and liquor stores, this sales tax increase would result in about $150 million of additional revenue for the city each year.

The Liquor Tax For 1877 Ann Arbor District Library

New York Liquor Tax - $6.44 / gallon. New York's general sales tax of 4% also applies to the purchase of liquor. In New York, liquor vendors are responsible for paying a state excise tax of $6.44 per gallon, plus Federal excise taxes, for all liquor sold. Additional Taxes: Under 24% - $2.54/gallon Additional $1.00/gallon in New York City.

E&J VS Brandy 750 ml Delivery in Fontana, CA Cherry Liquors, H & D

The Retail Beer, Wine and Liquor License Tax must be paid by all businesses licensed by the New York State Liquor Authority that sell beer, wine, or liquor at retail or for consumption on or off premises, within New York City.. Wine and Liquor License Tax. Tax Rate. The tax is 25% of the annual license fees imposed on retailers under the New.

Spec's liquor Stores Benaulim

Form title. MT-38. Instructions on form. Application for Annual Filing Status for Certain Liquor, Beer, and Wine Manufacturers. MT-39. MT-39-I (Instructions) Alcoholic Beverages Tax Clearance Return for Tax on Importation of Alcoholic Beverages into New York State for Personal Consumption. Use our online Jurisdiction/Rate Lookup by Address.

Liquor Market

Philip J. Cook, a Duke University professor emeritus and an expert on alcohol policy, says the solution is higher taxes. "The goal is not prohibition, but moderation," he writes in his book.

North Main Package "Liquor Store" Moultrie GA

New York State alcoholic beverages tax rates. Alcoholic beverage type. Tax rate. Liquor and wine containing more than 24% alcohol by volume (ABV) $1.70. Liquor and wine containing more than 2%, but not more than 24% ABV. $0.67. Wine containing 24% ABV or less. $0.30.

Liquor Taxes Could Go Up 400, Thanks to Congressional Dysfunction

Businesses licensed by the New York State Liquor Authority that sell retail beer, wine, or liquor in New York City. Tax Forms and Filing Information.. The tax is 25% of the annual license fees; however, if the license was issued after the beginning of the tax year (July 1), the tax is adjusted for the remaining number of days in that tax.

NYC TriBeCa Liquor Store At one point this former Liquo… Flickr

The New York beer excise tax was last changed in 2009 and has lost 0% of its value. If the tax had kept pace with inflation,. Step 2: Enter tax or fee increase for one or more alcohol categories. (e.g., Enter a ten-cent tax or fee increase for beer as 0.1 in the box under "Beer".) Step 3: Select a unit of measurement.

NYC Mortgage Recording Tax Guide (2023)

Liquor Tax. New York state places a 14 cent per gallon tax on beer, and NYC places a 12 cent per gallon tax on top of that. Wine has a 30 cent per gallon tax. Hard alcohol with an alcohol content of less than 24% incurs a state tax of $1.70 per liter plus 26 cents in NYC. Hard alcohol with an alcohol content over 24% has an additional tax of 67.

Seen at a local liquor store.

New York City imposes an additional excise tax on the sale or use of (1) beer and (2) liquor containing more than 24% of alcohol by volume. The tax itself is a set dollar amount per gallon or liter, as the case may be, of product sold or used (e.g. $0.30 per gallon of wine) ( see here ). Third Tier - Holders of retail liquor licenses are.

Liquor Store YouTube

As a distributor of alcoholic beverages, you are responsible for paying New York State's excise tax on alcoholic beverages ( beer, cider, wine, and liquor) when you sell or use these beverages within New York State. An additional tax is due on sales of liquor (including wine) over 24% alcohol by volume (abv), and beer, sold or used in New York.

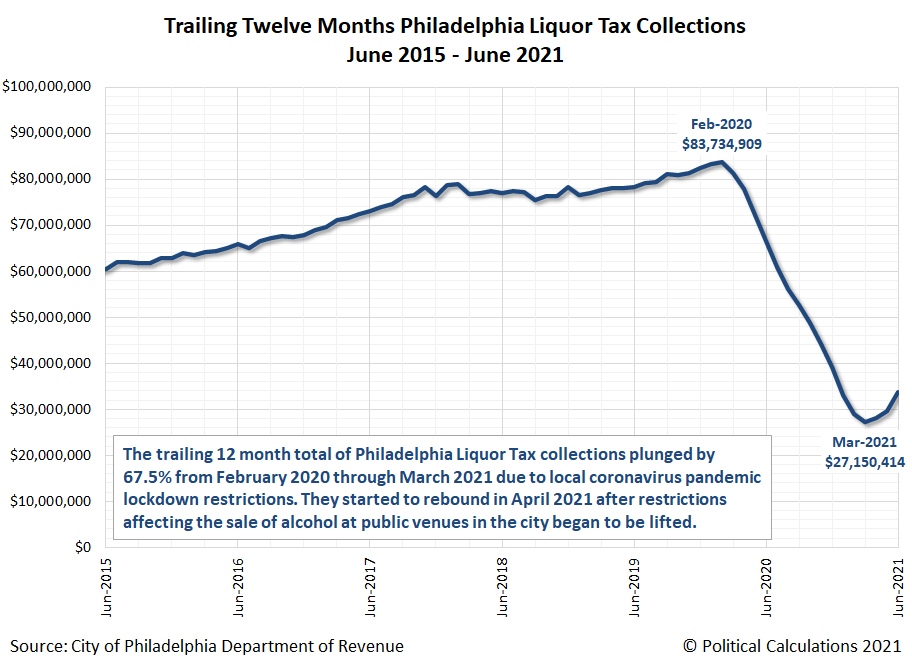

Ironman Blog What One City's Liquor Tax Collections Says About The

Tax can get complicated when it comes to direct-to-consumer (DTC) shipments. The beverage alcohol industry is different from other industries in that licensed alcohol shippers are required to register for sales tax in most states, independent of economic or physical nexus.. Depending on the state, sales and use tax can be applied at the state, county, city, or special district levels.

Liquor store Nueva Imperial

The federal government collects approximately $1 billion per month from excise alcohol taxes on spirits, beer, and wine. Taxes on spirits are significantly higher than beer and wine at $13.50 per gallon, while beer is taxed at $18 per barrel and wine is $1.07-$3.40 per gallon. This is because spirits have higher alcohol content than the other.

JT IRREGULARS Liquor stores in New York are considered 'essential

Distributor are New York State registered distributors of alcoholic beverages, this is an interdistributor sale. ACB Brewery can sell their beer to XZY Distributor without charging the alcoholic beverages tax after which XZY Distributor will be liable for the tax. ACB Brewery and XZY Distributor must both complete Form TP-218.

Nikka Coffey Malt Whiskey 750 ML CPD Wine and Liquor

The amount of credit per tax year for the first 500,000 gallons produced in New York State is: $2.54 per gallon of liquor with more than 2% but not more than 24% alcohol by volume (ABV), and. $6.44 per gallon of liquor with more than 24% ABV. In excess of 500,000 gallons, the credit is 4.5 cents (.045) per gallon up to 15 million additional.